interest tax shield explained

Missile defence shield threatening to undermine efforts by the new government in Seoul to overcome longstanding security differences. Potential for major tax savings.

Tax Shield Formula How To Calculate Tax Shield With Example

Russia on Tuesday accused the United States of direct involvement in the Ukraine war while the first ship carrying Ukrainian grain to world markets since Moscows invasion anchored safely off.

. Interest is earned from savings or investments and is considered passive income. Long island audit danbury lawsuit. It does not provide for reimbursement of any taxes penalties or interest imposed by taxing authorities and does not include legal representation.

The earnings rate is a combination of a fixed interest rate which stays the same as long as you hold the bondfor the life of the bond and an inflation-indexed rate which is adjusted twice a year. The tax help we provide in Dallas or Fort Worth includes. Adjusted Present Value - APV.

If you find that you have to file IRS Form 4868 to request an automatic six-month extension to file your personal income tax return this form also extends the time you have to file IRS Form 709. The adjusted present value is the net present value NPV of a project or company if financed solely by equity plus the present value PV of any financing benefits. Tax on interest earned.

We are your trusted Dallas tax attorney when looking for assistance with a variety of issues. Our tax resolution attorneys cater to everyone from individual taxpayers to multi-million dollar corporations helping them avoid the traps pitfalls and numerous complexities of the IRS tax system. Tax preparation may be more complex particularly if you opt for S Corp.

Compute tax savings from depreciation ie depreciation tax shield. IRS Form 709 is due on or before April 15 of the year following the year in which you make the taxable gifts. For companies the tax credit for the purchase of gas and electricity increases to 25.

The rate of Interest per annum 525. Owners who work in the business full-time may save on self-employment taxes with S Corp taxation. The taxes may also be referred to as income tax or capital taxA countrys corporate tax may apply to.

Taxation rates may vary by type or characteristics of the taxpayer and the type of income. Many countries impose such taxes at the national level and a similar tax may be imposed at state or local levels. Costs to establish and maintain.

You dont have to take any additional steps or file an extra form. Highest Open Interest. Examples of Progressive Tax.

Since we have learned the concept of after-tax cash inflow after-tax cost and depreciation tax shield now we can explain the impact of income tax on capital. The disagreement over the Terminal High Altitude Area Defence THAAD system emerged after an apparently smooth first visit to China by South Koreas foreign. Mr Bailey said earlier interest rate rises could have damaged the UKs economic recovery following the pandemic.

A 10 tax credit is also targeted at energy-intensive firms for natural gas purchased in the first quarter of 2022. These are taxes on investment income-generating activities. And hauliers will benefit from a 28 tax credit for the first quarter of 2022 for the expenditure incurred on the purchase of diesel.

Calculate the total amount of Interest the Company has to pay at the end of March 31 st 2019 if the rate of interest stands 525 annum. Additional terms and restrictions apply. The gift tax limit for individual filers for 2021 was 15000.

Choosing to establish a business organization as an S corporation could show the owners formal commitment to the company which could help build credibility among employees suppliers and investors. The Bank yesterday increased interest rates to 175 per cent - the highest in 27 years - while warning that Britain will plunge into a year-long recession this autumn. More complex tax requirements.

See Free In-person Audit Support for complete details. Grow demand and interest in your products or services. Loan taken by Tata Motors Ltd.

Capital budgeting with income tax. With S corporations states often pass profits and losses through to the owners though some states double-tax these owners. Houses for sale in live oak florida.

A team at Intermed Labs in. On one year ago INR 88950 Cr. Tenure 365 Days One Year Interest Expense is calculated using the formula given below.

HR Block tax software and online prices are ultimately determined at the time of print or e-file. It increases to 16000 for. While speaking with TV Insider about the puzzling phenomenon he explained that the plane may have gone to a certain.

Depreciation tax shield Tax rate Depreciation deduction 20000. Still show creator Jeff Rake is already dropping some major clues about where the plane might be. The annual gift tax exclusion was indexed for inflation as part of the Tax Relief Act of 1997 so the amount can increase from year to year to keep pace with the economy but only in increments of 1000.

They tend to impact those with excess money that save and engage in investment. LLCs require government forms and fees to establish and maintain. China and South Korea clashed on Thursday over a US.

A corporate tax also called corporation tax or company tax is a direct tax imposed on the income or capital of corporations or analogous legal entities. Although there is a chance to deduct all the. An income tax is a tax imposed on individuals or entities taxpayers in respect of the income or profits earned by them commonly called taxable incomeIncome tax generally is computed as the product of a tax rate times the taxable income.

1 of 3 The SNAPS eye shield is shown modeled on a mannequin head while a computer screen shows other shields and a SNAPS prototype in Morgantown WVa. The American Investment Council which represents private equity firms including Sinema contributor Blackstone quickly came out against the carried interest provision claiming it would harm. The Bank of England governor has defended delays in hiking the interest rate.

Gluco Shield Pro is a supplement made with high-quality herbs vitamins and minerals all working on one purpose to maintain healthy blood sugar levels. The Annual Gift Tax Exclusion for Tax Year 2022.

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Meaning Importance Calculation And More

Tax Shield Formula How To Calculate Tax Shield With Example

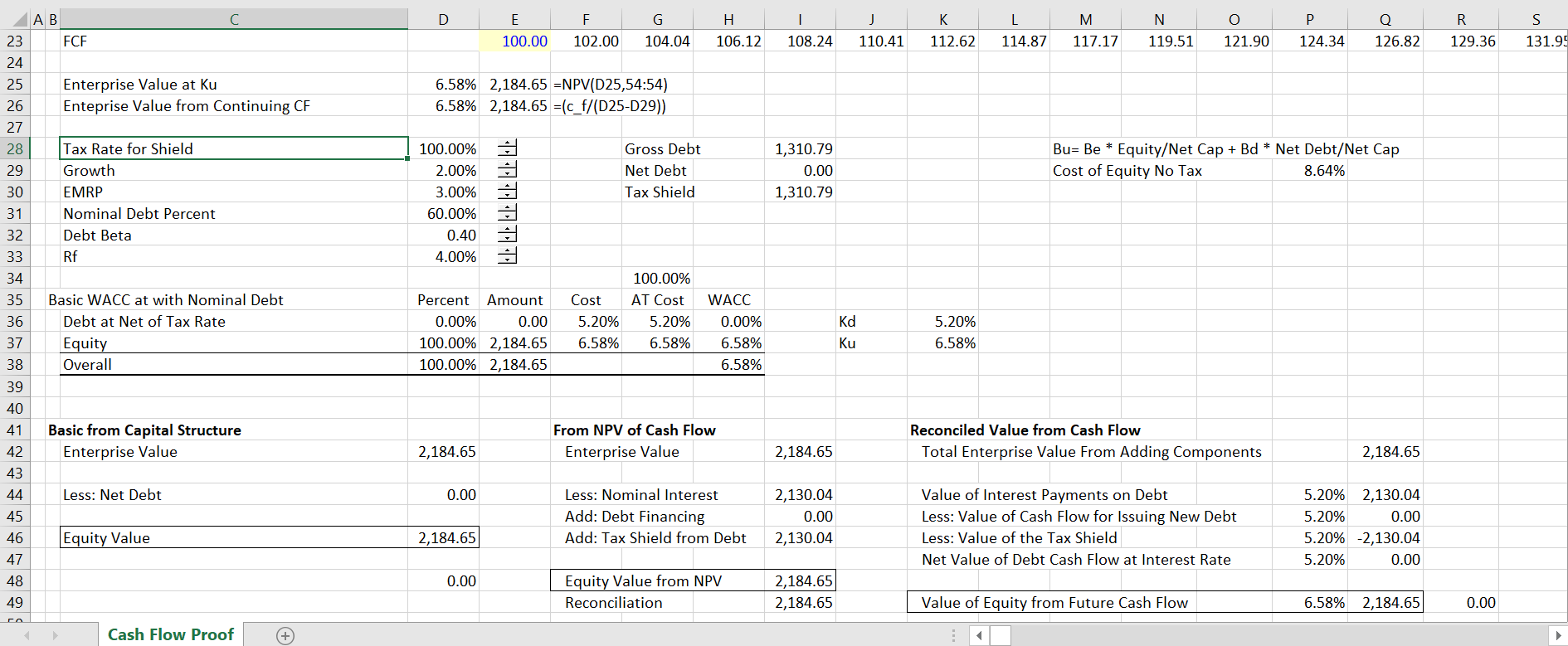

Resolution Of Tax Shield On Interest Expense In Wacc Edward Bodmer Project And Corporate Finance

Tax Shield Formula Step By Step Calculation With Examples

Interest Tax Shield Formula And Calculator Excel Template

Tax Shield Formula Examples Interest Depreciation Tax Deductible

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula How To Calculate Tax Shield With Example

Interest Tax Shield Formula And Calculator Excel Template

Modigliani And Miller Part 2 Youtube

The Interest Tax Shield Explained On One Page Marco Houweling

Resolution Of Tax Shield On Interest Expense In Wacc Edward Bodmer Project And Corporate Finance

Tax Shields Financial Expenses And Losses Carried Forward