michigan.gov property tax estimator

The median property tax in Michigan is 214500 per year for a home worth the median value of 13220000. This Treasury portal offers one place for taxpayers to manage all their Individual Income.

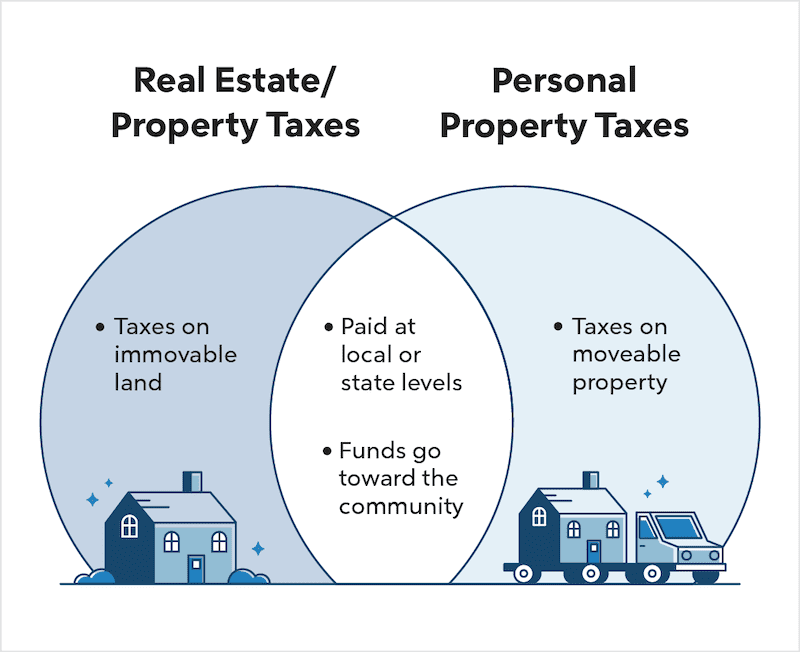

Real Estate Taxes Vs Property Taxes Quicken Loans

The Federal or IRS Taxes Are Listed.

. Michigans Wayne County which contains the city of Detroit has not only the highest property tax rates in the state but also some of the highest taxes of any county in the US. Welcome to the NEW eServices portal. Application for State Real Estate Transfer Tax SRETT Refund.

Office of Inspector General. Use this estimator tool to determine your summer winter and yearly tax rates and amounts. You can now access estimates on property taxes by local unit and school district using 2020 millage rates.

Worksheet 2 Tier 3 Michigan Standard Deduction Estimator. 313 343-2785 Tax Questions. Office of the Auditor General.

Property owners can calculate their tax bill by multiplying their taxable value by the millage rate. Inquire about General Topics. Counties in Michigan collect an average of 162 of a propertys assesed fair.

Simply enter the SEV for future owners or the Taxable Value. Enter the Taxable Value of your property and select the school district from the options. Get Assessment Information From 2022 About Any County Property.

Homestead Property Tax Credit. The Internal Revenue Service. Interest is calculated by multiplying the unpaid tax.

You can now calculate an estimate of your property taxes using the current tax rates. The State Education Tax Act SET requires that property be assessed at 6 mills as part of summer property tax. 313 343-2435 Water Billing.

Computing real estate transfer tax is done in increments of 500. Novitke Municipal Center 20025 Mack Plaza Grosse Pointe Woods MI 48236. The Revenue Act includes provisions for charging penalty and interest if a taxpayer fails to pay a tax within the time specified.

You can now access estimates on property taxes by local unit and school district using 2020 millage rates. The Michigan Department of Treasury does not administer the federal stimulus program or have any information regarding federal stimulus payments. The Michigan Tax Calculator Will Let You Calculate Your State Taxes For the Tax Year.

Follow this link for information regarding the collection of. 41010 - Grand Rapids 41020 - Godwin 41050 - Caledonia 41110 - Forest Hills. Business Tax Forms Instructions.

Pin On Income Resulting Property Tax Estimate Special Notes. For example if the citys millage rate is 10 mills property taxes on a home with a taxable value. Simply enter the SEV for future owners or the Taxable Value.

Get help with Tax Preparation. Worksheets 4 Recipients of FIPMDHHS 5 Renters Age 65 Estimator. The state charges 375 for each increment and the county charges 55 which an be up to 75 as authorized by the.

The median property tax in Michigan is 214500 per year for a home worth the median value of 13220000. Ad Find County Online Property Taxes Info From 2022.

Michigan Property Tax H R Block

2022 Property Taxes By State Report Propertyshark

States In America Gas Tax States

State And Local Sales Tax Rates 2013 Map Income Tax Property Tax

Michigan Estate Tax Everything You Need To Know Smartasset

Tax Bill Information Macomb Mi

Property Taxes Property Tax Analysis Tax Foundation

States With The Highest And Lowest Property Taxes Property Tax Tax States

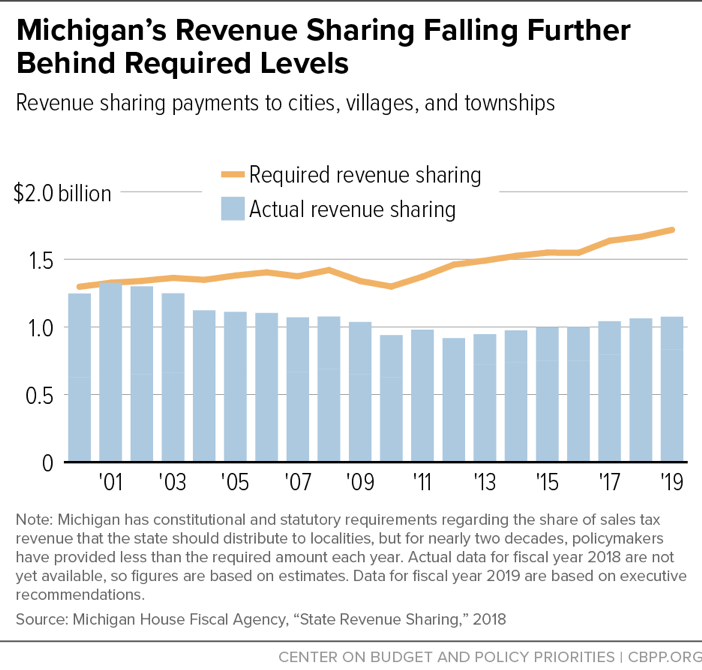

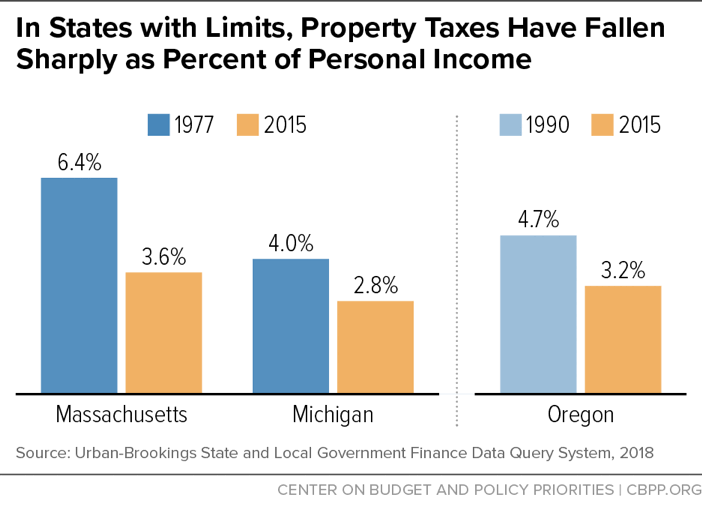

State Limits On Property Taxes Hamstring Local Services And Should Be Relaxed Or Repealed Center On Budget And Policy Priorities

Understanding Your Property Tax Bill Clackamas County

Why Should I Own If I Can Rent Lovelansing Lansing Puremichigan Igersmichigan Michigan Dewittmichigan Dewittmi Ok Sell My House Lansing Michigan Lansing

Michigan Property Transfer Tax Calculator Calculate Real Estate Transfer Tax In Michigan

Wisconsin Property Tax Calculator Smartasset

State Limits On Property Taxes Hamstring Local Services And Should Be Relaxed Or Repealed Center On Budget And Policy Priorities

State Limits On Property Taxes Hamstring Local Services And Should Be Relaxed Or Repealed Center On Budget And Policy Priorities

Michigan Property Transfer Tax Calculator Calculate Real Estate Transfer Tax In Michigan